Pokémon TCG Investing: Sealed Products to Double Value by 2026

Advertisements

For those looking to capitalize on the booming collectibles market, understanding which Pokémon TCG sealed products will double in value by 2026 is crucial for strategic investment and significant returns.

Anúncios

Are you looking to turn your passion for pocket monsters into a profitable venture? The world of Pokémon TCG investing has seen unprecedented growth, transforming sealed products into genuine assets. With the right knowledge and a keen eye, identifying which sealed products are poised to double in value by 2026 is not just a pipe dream, but a tangible goal for savvy collectors and investors alike.

Understanding the Pokémon TCG Market Dynamics

The Pokémon Trading Card Game market is a fascinating blend of nostalgia, speculation, and genuine rarity. Its rapid expansion over the past few years has caught the attention of mainstream investors, moving it beyond a niche hobby. Understanding the underlying forces that drive value is the first step toward making informed investment decisions. This isn’t just about buying any sealed box; it’s about strategic acquisition.

Anúncios

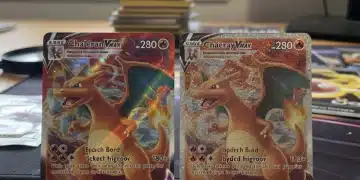

Several factors contribute to a sealed product’s potential for appreciation. These include the set’s print run, the popularity of the Pokémon featured, the inclusion of chase cards, and the overall sentiment of the collecting community. A smaller print run often correlates with higher future value due to scarcity. Similarly, sets featuring iconic Pokémon like Charizard, Pikachu, or Eeveelutions tend to perform exceptionally well.

Factors Driving Value Appreciation

The market’s health is often dictated by a delicate balance of supply and demand. When a set is popular, and its supply is limited, prices naturally climb. This is particularly true for older, out-of-print sets, but modern sets can also see significant gains if they hit certain criteria. Investors need to be mindful of trends and historical performance.

- Scarcity: Limited print runs or short production windows significantly boost long-term value.

- Iconic Pokémon: Sets featuring fan-favorite Pokémon tend to maintain or increase their worth.

- Chase Cards: The presence of highly desirable, rare cards within a set drives demand for sealed products.

- Community Hype: Positive reception and sustained interest from the collector community are vital.

Ultimately, successful investment in Pokémon TCG sealed products requires a deep dive into these dynamics. It’s about predicting future demand based on current trends and historical data, rather than simply hoping for the best. A well-researched approach can differentiate between a stagnant asset and a burgeoning goldmine.

Identifying Promising Modern Sets for Investment

While vintage sets are already established in value, the real challenge and potential for significant returns lie in identifying modern sets that have not yet reached their peak. Looking ahead to 2026, certain recent releases show strong indicators of future appreciation. These are the sets that captured the community’s imagination or contained uniquely desirable elements.

Modern sets often benefit from higher production quality and more intricate artwork, appealing to a broader audience. However, the sheer volume of modern releases means careful selection is paramount. Not every set will be a winner, but those with specific characteristics stand out. It’s like picking a future MVP in a crowded rookie class.

Key Characteristics of High-Potential Modern Sets

When evaluating modern sets, look for those that introduced new mechanics, celebrated significant anniversaries, or featured particularly stunning alternative art cards. These elements create unique selling propositions that can drive demand years down the line. The initial market reception is also a strong indicator of long-term potential.

- Unique Mechanics/Gimmicks: Sets that innovate with gameplay or card types often become memorable.

- Anniversary Sets: Special releases celebrating milestones tend to hold sentimental and monetary value.

- Stunning Alt Arts: Cards with exceptional, full-art illustrations are highly sought after.

- Low Pull Rates for Rares: If desirable cards are notoriously difficult to pull, sealed product demand increases.

Focusing on these attributes helps narrow down the field of potential investments. It’s not just about the Pokémon on the box, but the entire package and its perceived value within the collecting ecosystem. Investors should stay informed about new releases and monitor their initial performance closely.

The Enduring Appeal of Special Edition Boxes and Collections

Beyond standard booster boxes, special edition boxes and collection sets often present unique investment opportunities. These products typically come with guaranteed promotional cards, exclusive accessories, or limited-edition packaging that can significantly enhance their long-term value. Their scarcity is often built-in, making them attractive targets for investors.

These specialized releases are designed to be collector’s items from day one. They often feature popular Pokémon or commemorate special events, which gives them an intrinsic value beyond just the cards they contain. Think of them as premium packages that offer more than just a chance at a rare pull.

Why Special Editions Outperform

The limited nature of these releases is a primary driver of their increased value. Unlike standard booster boxes that might see multiple print runs, special collections are often one-and-done deals. This inherent scarcity, combined with exclusive content, makes them highly desirable for collectors who missed out on the initial release.

- Guaranteed Promos: Exclusive promo cards often become valuable on their own.

- Unique Packaging: Special boxes and displays can be collector’s items.

- Limited Availability: Often produced in smaller quantities, making them rarer.

- Themed Content: Focus on specific Pokémon or events appeals to dedicated fans.

Investing in these types of products requires quick action upon release, as they tend to sell out rapidly. Resale prices can surge quickly, especially if the included promo cards or exclusive items become highly sought after. Researching upcoming special releases and understanding their potential impact on the market is key.

Evaluating the Impact of Popular Pokémon on Value

The Pokémon themselves play an undeniable role in the investment potential of sealed products. Certain Pokémon have consistently demonstrated an ability to drive demand and increase value, acting as market bellwethers. Understanding which creatures hold this sway is crucial for any serious investor.

For example, Charizard cards, regardless of the set, almost always command a premium. This isn’t just about gameplay utility; it’s about cultural significance and nostalgic appeal. Other Pokémon, like Pikachu, Eeveelutions (Eevee, Vaporeon, Jolteon, Flareon, Espeon, Umbreon, Leafeon, Glaceon, Sylveon), and legendary Pokémon also consistently perform well.

Top-Tier Pokémon for Investment

When assessing a sealed product, consider the prevalence and rarity of these beloved Pokémon within the set. A set with multiple chase cards featuring popular Pokémon is inherently more attractive than one without. These Pokémon often transcend generational gaps, appealing to both new and veteran collectors.

- Charizard: The undisputed king, any set featuring a rare Charizard is a strong contender.

- Pikachu: The franchise mascot always holds significant value, especially special editions.

- Eeveelutions: The various evolutions of Eevee are consistently popular and highly collectible.

- Legendary/Mythical Pokémon: Powerful and rare, these often drive demand for their respective sets.

- Fan Favorites: Pokémon like Gengar, Mewtwo, and Lugia also have dedicated fan bases.

It’s not just about the Pokémon, but also the artwork. An aesthetically pleasing card featuring a popular Pokémon can become an instant classic, driving up the value of the sealed product it comes from. Staying attuned to community preferences and viral card art can provide a significant edge.

The Critical Role of Proper Storage and Authentication

Once you’ve acquired promising sealed products, their long-term value heavily depends on proper storage and, when necessary, authentication. A pristine condition is paramount for maximizing returns. Even minor damage to packaging can significantly reduce its market appeal and potential appreciation.

Think of sealed Pokémon TCG products as delicate artifacts. They need protection from environmental factors like humidity, temperature fluctuations, and physical damage. Neglecting these aspects can turn a valuable investment into a regrettable loss. Preservation is just as important as selection.

Best Practices for Preserving Value

Investing in appropriate storage solutions is a non-negotiable part of the process. This includes specialized containers, climate-controlled environments, and careful handling. For high-value items, professional authentication and grading of individual cards (once opened, though this article focuses on sealed products) also play a crucial role in establishing legitimacy and value.

- Temperature Control: Store in a cool, stable environment to prevent warping or damage.

- Humidity Regulation: Use desiccants or dehumidifiers to prevent moisture damage.

- Protective Cases: Invest in acrylic cases or plastic wraps for booster boxes and ETBs.

- Original Packaging: Keep all original seals intact; opened products lose significant value.

- Authentication: For individual rare cards, consider professional grading services to verify authenticity and condition.

Maintaining the integrity of sealed products is a commitment. It ensures that when the time comes to sell, your investment is presented in the best possible condition, commanding top dollar. Skipping this step is a common mistake that can severely limit profit potential.

Market Trends, Predictions, and Future Outlook for 2026

Predicting the future of any market is challenging, but by analyzing current trends and historical patterns, we can make educated guesses about which Pokémon TCG sealed products will likely double in value by 2026. The market is influenced by anniversaries, new game releases, and the overall health of the brand.

The Pokémon franchise continues to expand with new video games, animated series, and merchandise, ensuring a steady stream of new fans and renewed interest from older ones. This constant influx of engagement is a powerful driver for the TCG market. However, investors should remain cautious and diversified.

Anticipated Growth Drivers

Several factors suggest continued growth for the Pokémon TCG market. The ongoing nostalgia wave, combined with new generations of collectors entering the hobby, creates a robust demand environment. Specific sets tied to major franchise events or featuring groundbreaking card designs are particularly well-positioned for future appreciation.

- Franchise Anniversaries: Major milestones often lead to special, highly collectible TCG releases.

- New Game Releases: Popular new video games can spark renewed interest in associated TCG sets.

- Economic Climate: A stable economy generally supports collectibles markets, though recessions can also increase demand for alternative investments.

- Social Media Influence: Viral trends and popular content creators can significantly impact demand for specific products.

While no investment is guaranteed, a strategic approach to Pokémon TCG sealed products, focusing on rarity, popularity, and proper preservation, offers a strong chance for substantial returns by 2026. Continuous research and adaptability to market shifts will be crucial for success in this dynamic investment landscape.

| Key Investment Factor | Brief Description |

|---|---|

| Scarcity & Print Run | Limited availability of sealed products significantly boosts future value due to high demand. |

| Iconic Pokémon & Chase Cards | Sets featuring popular Pokémon or highly sought-after rare cards drive collector interest. |

| Special Editions | Unique boxes with exclusive promos or packaging often have built-in scarcity and value. |

| Proper Storage | Preserving sealed products in pristine condition is crucial to maximize their long-term investment value. |

Frequently Asked Questions About Pokémon TCG Investing

Look for sealed booster boxes and elite trainer boxes from sets with limited print runs, iconic Pokémon like Charizard or Pikachu, and highly sought-after chase cards. Special anniversary sets or those introducing unique mechanics also tend to perform well over time.

High growth potential products often have strong initial community hype, feature stunning alternative art cards, or contain notoriously difficult-to-pull rare cards. Researching initial market reception and community sentiment can provide valuable insights into future appreciation.

Risks include market fluctuations, potential reprints that devalue products, and damage due to improper storage. The market can be unpredictable, so diversification and thorough research are essential to mitigate potential losses in your investment portfolio.

Older, vintage sealed products often have established high values but less room for exponential growth. Newer products offer higher growth potential if chosen wisely, but also carry more risk due to uncertain future demand and potential reprints. A balanced approach can be beneficial.

Proper storage is critically important. Environmental factors like temperature, humidity, and physical damage can severely devalue sealed products. Investing in protective cases and maintaining a stable storage environment ensures the product retains its pristine condition and maximizes its long-term market value.

Conclusion

The landscape of Pokémon TCG investing is dynamic and full of potential for those willing to do their homework. While no investment is without risk, a strategic approach focused on understanding market dynamics, identifying promising modern sets and special editions, and recognizing the impact of popular Pokémon can significantly increase your chances of seeing sealed products double in value by 2026. Remember, proper storage and continuous market research are not just recommendations, but crucial components of a successful investment strategy in this exciting and evolving collectible market.